Bright banking

The bank account that works hard for you and your money. Join the millions of people already banking with Monzo.

Everything you'd expect from your bank, on your phone

An award-winning UK current account in an easy to use app. Complete with a Hot Coral debit card, help when you need it and FSCS protection for eligible deposits up to £85,000 per person.

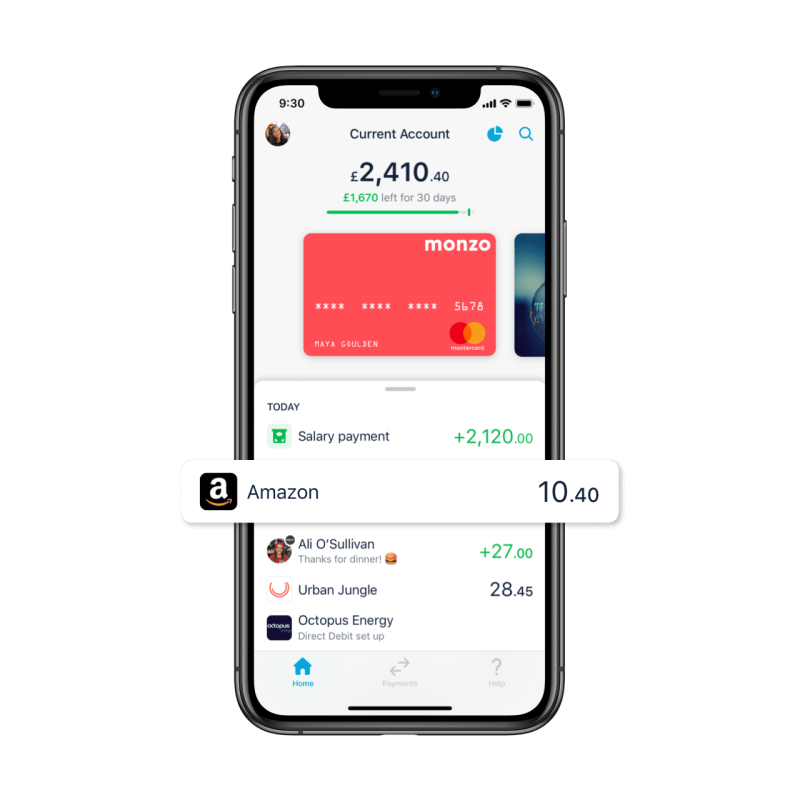

A clear view

See a true reflection of your money at all times, and we’ll tell you about important things as they happen with handy notifications.

Instant notifications

What you just bought, where you bought it and for how much, before the receipts even printed. We’ll ping you about other important activity too, so you’re always in the know.

Spending categories

We automatically sort your payments into categories so you can see what you’re spending on each month.

Keep track of your regular payments

We’ll let you know if a Direct Debit or standing order’s going to be more or less expensive than last time, the day before the money’s due to come out.

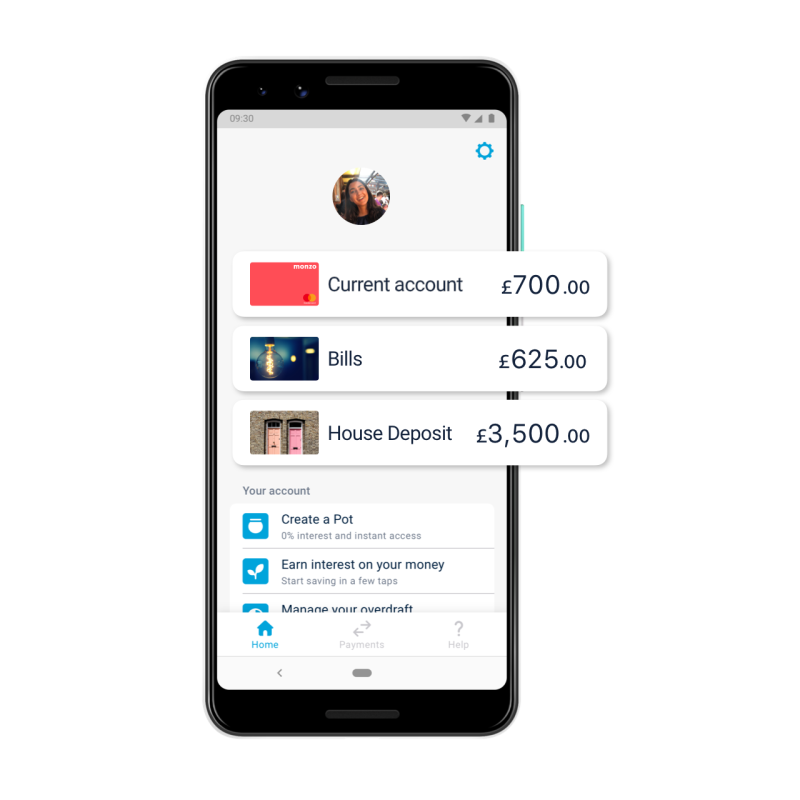

Money, managed

Finally, you’re in control – free to manage your income, spending and savings however it suits you.

Pots for setting money aside

Places to grow your savings or keep money separate from what you’re happy to spend.

Automatically sort your income

Once you’re paid, automatically move your money to different Pots – letting you set aside savings, bills money, money for a rainy day or whatever you like. All without the manual work.

Clever ways to manage your bills

Keep what you need for bills in a Pot. When the bill’s due, we’ll pay it from your Pot automatically.

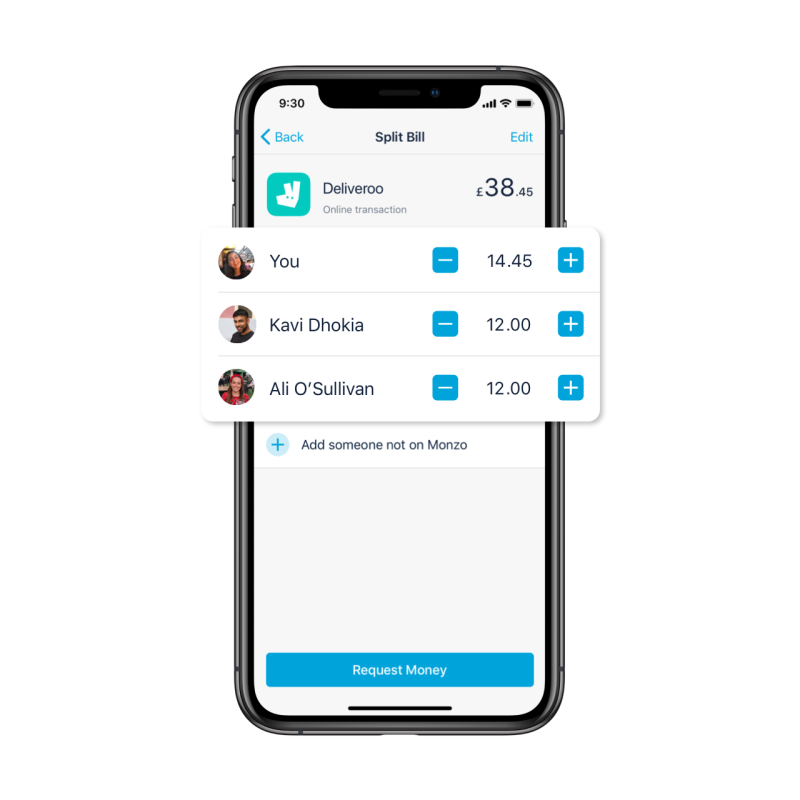

Make life easier

Move money around without the hassle (or a calculator), all in an award-winning app.

Pay anyone seamlessly

Forget sort codes and account numbers. Pay someone in a few taps, or share a link if they’re not on Monzo for hassle-free payments.

Split the bill

Having dinner with friends? Pay for everyone and then split the bill after. We divide up who owes what so you don’t have to do the maths.

Share the tab

Going on holiday or just looking for a way to track who owes what in a shared house? Add payments to your shared tab so you can settle up as you go, or at some point in the future.

Free

A UK current account

With savings, borrowing and overdrafts

Your money is protected by the FSCS

Your eligible deposits are protected by the FSCS up to a value of £85,000 per person

4.10% AER interest (variable)

On balances up to £100,000 in a Personal Instant Access Savings Pot, paid monthly

Fee-free UK bank transfers

Send money to any UK bank for free

Pots for separating money

Put money aside from your balance

Award-winning support

Through the app, if you need it

Instant notifications

See when, where and how you spend

Apple Pay and Google Pay

Spend using your phone

Spending categories

Get a clear view of your spending

£5 per month

Must be over 18

All free Monzo features

Other accounts, in Monzo

See your other accounts in Monzo

4.60% AER interest (variable)

On balances up to £100,000 in a Personal Instant Access Savings Pot, paid monthly

Holographic card

Exclusive to Monzo Plus

Custom categories

Plus, divide payments into multiple categories

Virtual cards

Avoid using your physical card online

Advanced roundups

Make your spare change go further

Credit Tracker

See how your credit score changes

Offers

15% off Patch and many more

Fee-free withdrawals abroad

Up to £400 free every 30 days

Auto-export transaction

Live updates to Google Sheets

1 free cash deposit a month

At PayPoints across the UK

All free Monzo features

All Monzo Plus features

Metal card

Exclusive to Monzo Premium

Phone insurance

Covers loss, damage, theft, and cracks. Exclusions apply

Worldwide travel insurance

Cover for you and your family when travelling together. Exclusions apply

4.60% AER interest (variable)

On balances up to £100,000 in a Personal Instant Access Savings Pot, paid monthly

Get discounted access to over 1,100 airport lounges

You and guests can travel in style

Fee-free withdrawals abroad

Up to £600 every 30 days

5 free cash deposits a month

At PayPoints across the UK

Not sure what to pick?

Compare each account to find the right one for you

Easy current account switching

With the Current Account Switch Service, you can move everything over to Monzo in 7 days without lifting a finger. We do everything for you, and you don’t need to deal with your old bank at all.

How much can you withdraw from an ATM?

The daily amount that you can withdraw from an ATM depends on what bank you're with and the type of account you have.

Improved international transfers, powered by Wise

It's typically lower cost and easier to make an international transfer with Monzo than with high street banks.

Introducing Monzo Premium

We’re launching Monzo Premium – banking that makes a statement with our white metal card. Get phone and worldwide travel insurance, interest on your balance and regular Pots, and much, much more.

Can I have more than one bank account?

Yes! You can have as many current accounts as you like. Find out why you won't hurt your credit score, so long as you follow this post! ✅

How long should you keep bank statements?

Keeping hold of your bank statements can be useful when applying for a mortgage, a loan, or when filing your tax return. Find out how long you should keep yours ✅

What is FSCS protection?

Up to £85,000 of the money in your Monzo account is protected by the government. Find out what FSCS protection is and how it can help you.