A few months back we shared how we’re supporting you and your money through the cost of living crisis. We promised to keep you updated about what we’re seeing and hearing from you, our customers, and how our support is evolving. We’re back now with an update on what’s new, and a reminder on the ways we can help.

We’ve made our best budgeting features free to all

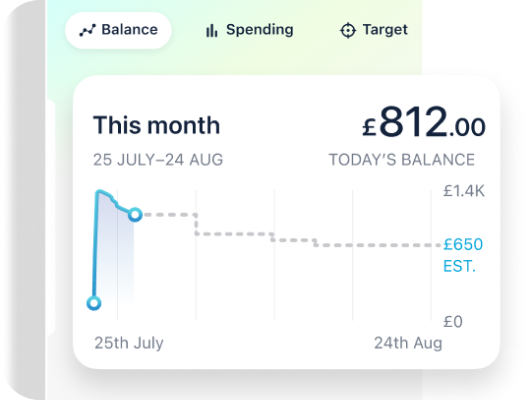

Lots of people have been telling us that our budgeting tools are a big help as costs increase and money gets tighter. So we decided to make the main elements of our newest and most helpful tools available to everyone, for free. The balance, spending and targets views in Trends all help you see exactly what's going on with your money.

If you head to your Trends tab right now you’ll find all of these are ready for you to use.

Balance view – get a clear look at how it changes over time

The balance view in Trends shows you how your total balance changes over time, including a forecast of how much you’ve got left to spend based on your upcoming bills and spending habits.

Tap into the graph at any point to see exactly what you spent that day, and swipe back and forward in time to see previous months. Zoom out for an overview of your balance across a whole year.

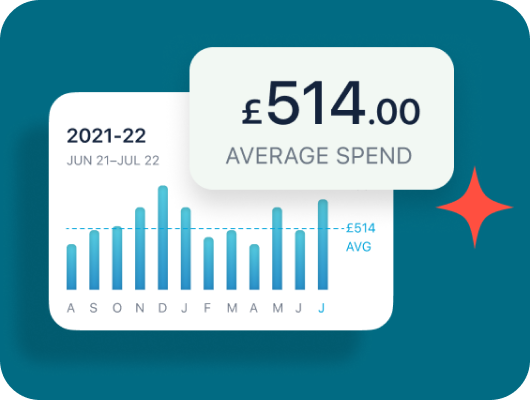

Spending view – see where your money’s going

The spending view shows you where your money’s going by category and merchant. As with the ‘balance’ view, you can swipe back and forward in time, and change the time period you’re looking at for a more zoomed in or zoomed out view.

Seeing your spending patterns visualised this way gives you insight into your behaviour and helps you reinforce good habits, or adopt new ones.

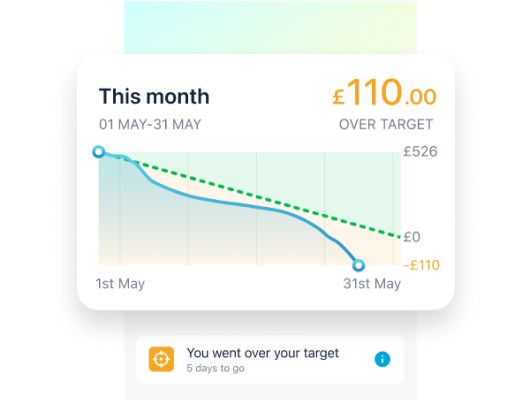

Targets view – set targets and track them in real-time

Lastly, the brand new target view lets you set a single overall spending goal for the month, and choose which Monzo accounts and categories to include.

And because we know everyone's pay cycles are different, you can set when your month starts and ends to fit your schedule. We then show you an interactive graph to plot how you’re doing against your target, so it’s easy to see if you’re on track.

Set controls to limit what you can spend

A lot of spending throughout the month is essential and there's little you can do about it. For the rest of your spending, there are some tools in the Monzo app which can help you stay within the amount you're comfortable with.

You can choose to set your contactless spending limits to an amount that suits your budget, and you can do the same for your daily spending and transfer limits too.

Head to the Manage tab in your Monzo app and you'll find a Limits section where you can change your settings at any time.

Read more about customising your spending limits

Earn more interest on savings now that rates have gone up

If you’re in a position to save then you’ll be happy to know that interest rates on our Savings Pots have gone up, meaning the money you put into savings now earns you more interest than before.

Opening a Savings Pot comes with no fees or charges and we don't cap how much you can put into savings before the rate changes. The rate you see is the rate you get.

We'll continue working with our partners to make sure our rates stay competitive.

Easy Access Savings Pot

If you want to put your money into savings but want the option to access it if you need it, the Easy Access Savings Pot earns 2.16% AER / 2.14% Gross (variable) interest, with the interest paid to you monthly. For this option you need to make a minimum first deposit of £10.

Fixed Rate Savings Pots

If you’re comfortable locking some money away for a minimum of 6 months you can earn more interest. A 6 month Fixed Rate Savings Pot can earn you 3.55% AER / Gross interest, paid to you at the end of the 6 months. For the 12 month option it’s 3.90% AER / Gross, with the interest paid to you after the 12 month term. Both Fixed Rate Savings Pots have a minimum deposit of £500.

Easy Access ISA

An Easy Access ISA can help you earn tax-free interest at 2.00% AER / 1.98% Gross (variable). This savings option has a £10 minimum deposit. We do have to mention that your tax treatment will depend on your individual circumstances and it may change in the future.

These savings rates were correct on the date we published the blog post but for the up to date rates always check the Monzo app. Ts&Cs apply.

We’re still here to support you

Our award-winning support teams are on hand to help all customers, but particularly those in vulnerable circumstances of any kind, including financial difficulties.

We recommend checking out our money worries hub as a good place to start. We’ve listed some of our own resources and guidance from others that we hope are helpful.

Visit our money worries hub

If you receive DWP payments you might be able to save on your utility bills

If you receive Department for Work & Pensions (DWP) cost of living payments paid into your Monzo account you should have had an email from us letting you know that you might be eligible for ‘social tariffs’. They’re cheaper packages which some broadband and phone providers offer for people receiving benefits. You don’t need to be receiving these payments into a Monzo account to potentially be eligible.

Find out more about ‘social tariffs' on the Ofcom website

Specialist support is here if you need it

If you’re worried about keeping up with borrowing repayments, or your circumstances have changed, please let us know right away so we can help you. Head to the Help tab in-app where you can get more info and chat to us if you need to.

If there’s anything that affects the way you deal with your money, how you communicate with us, or if you have somebody helping you with your banking, you can leave a note for our Specialist Teams through ‘Share with us’ about anything you'd like us to know.

We won’t always be the right people for the support you need. If you tell us a little about your situation we can point you to the right specialist organisations who offer free, impartial advice on topics from managing debt to dealing with anxiety.

If we do suggest you get some independent advice, that doesn’t mean we won’t also do whatever we can to help.

Read more about some of the charities and organisations we signpost

Be aware of how fraudsters operate

Unfortunately fraudsters will always try to take advantage of people, even in such tough times. So, we’ve gathered advice on how to spot suspicious activity, including people pretending to be the police, utility suppliers, HMRC or your bank.

If you’ve been tricked into sending someone money, speak to us immediately either over the phone or through the app.

Read more about spotting potential scams

We’ll be back with another update soon

That’s our update for now but as always, we’re listening to our customers and working on new ways to support you.

If there are things you think we could be doing to help then we’d love to hear from you.