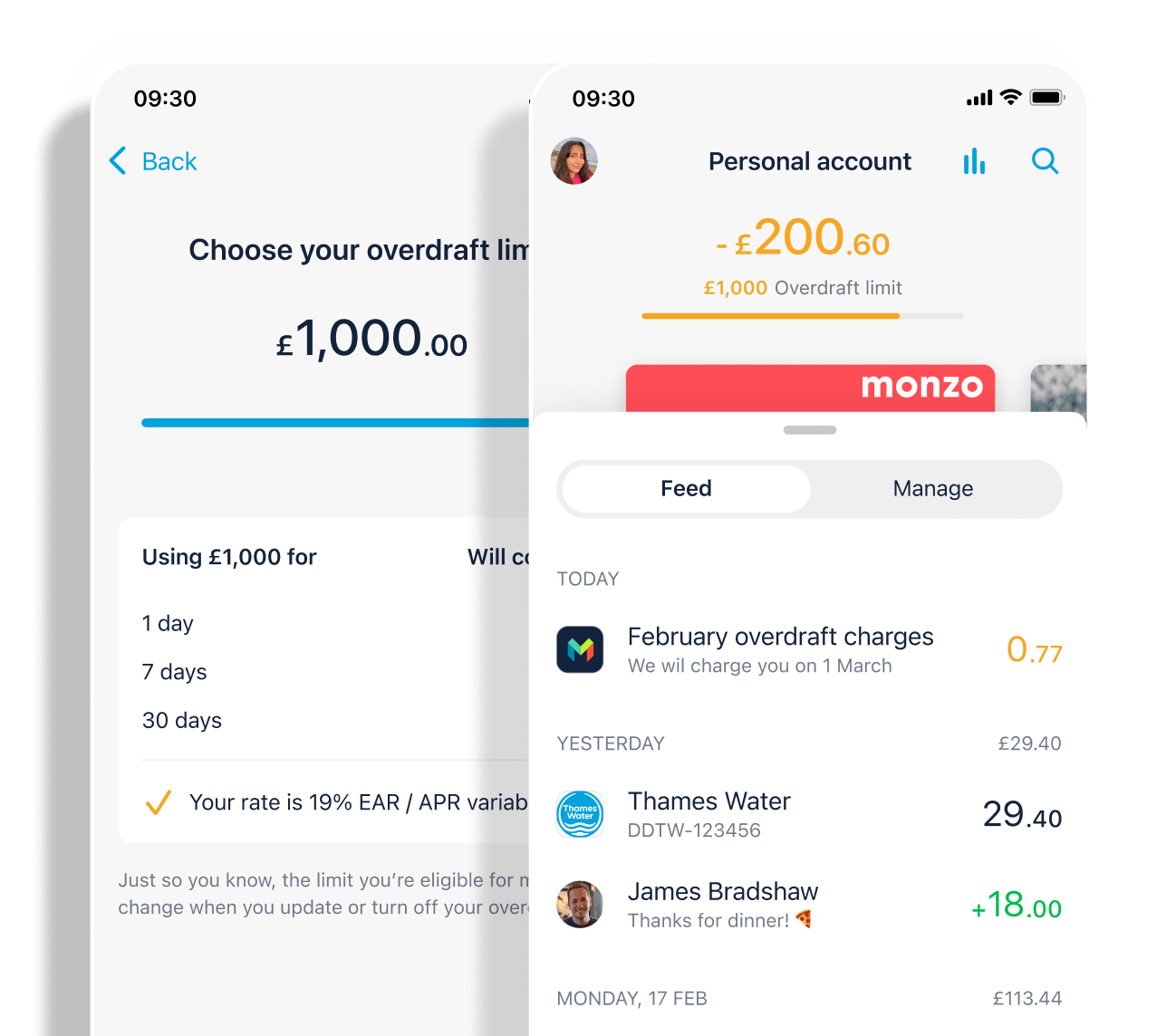

Overdrafts

Arranged overdrafts can be ideal if you need to borrow a little extra money to tide you over every now and then.

Overdrafts are designed for short term borrowing, and they’ll cost you less if you pay them back quickly.

Arranged and unarranged overdrafts

When you switch on an overdraft with Monzo that's called an arranged overdraft. If you go over your arranged overdraft limit or you don't have an arranged overdraft we'll reject payments (for free), but there are some times when we can't reject payments. We've explained how it works below:

If you go over your agreed overdraft limit We’ll reject any payments that take you over your limit, and you won’t be able to take cash out. The only exceptions are ‘offline’ payments, like those you make to TfL. We can’t reject these, so you’ll go into an unarranged overdraft, but we'll tell you as soon as this happens. You'll have until midnight to add money to your account, so you can avoid charges or any impact on your credit score (which might make it harder for you to borrow in the future).

If you go into an unarranged overdraft we’ll charge you the same rate we would if you were using your arranged overdraft, and we will cap the charges at £15.50 per month, so you will never pay more than that.

If you don’t have an arranged overdraft If your account is empty, we’ll reject payments unless they’re payments as described above. We’ll send you a notification and you'll have until at least midnight that day to add some money.

If you don’t pay it back in time, we’ll charge you interest at 39% EAR (variable). The monthly cap on unarranged overdraft charges for Monzo personal accounts is £15.50. Further details can be found here.