Car loans with Monzo

If you're heading to the dealership to buy a new or used car, you could use a Monzo personal loan to help you buy it.

Check if it's less expensive than car finance in minutes, and you could have the money in your account a few minutes later.

If you’re eligible, our representative APR is 14.8% for loans more than £10,000, up to £25,000. For loans up to £10,000 it’s 28.8%.

Easier than car finance

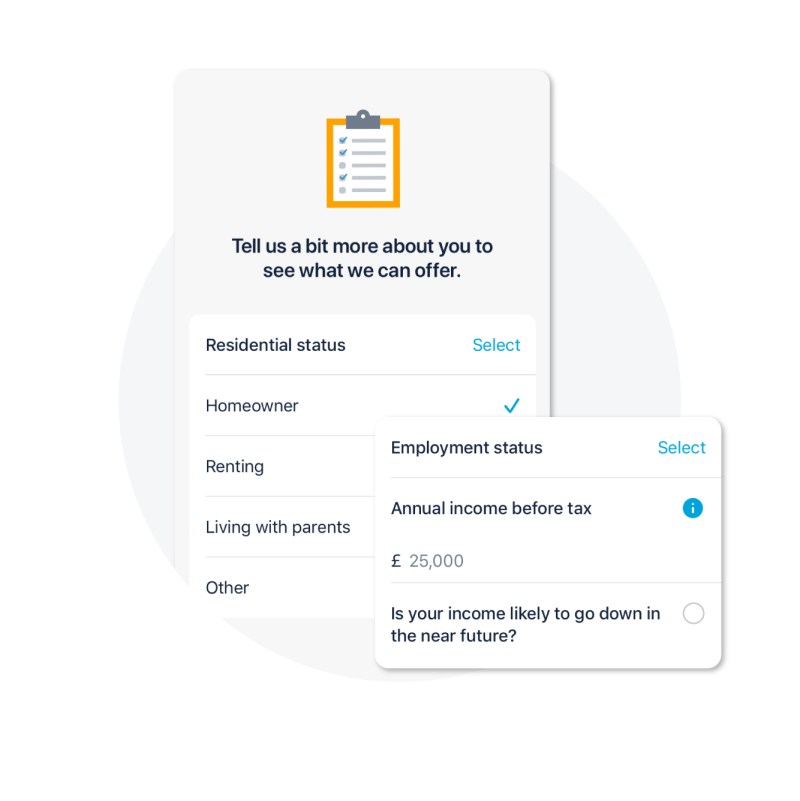

You can see what you're eligible for in minutes, so you can check if it's cheaper than car finance on the forecourt.

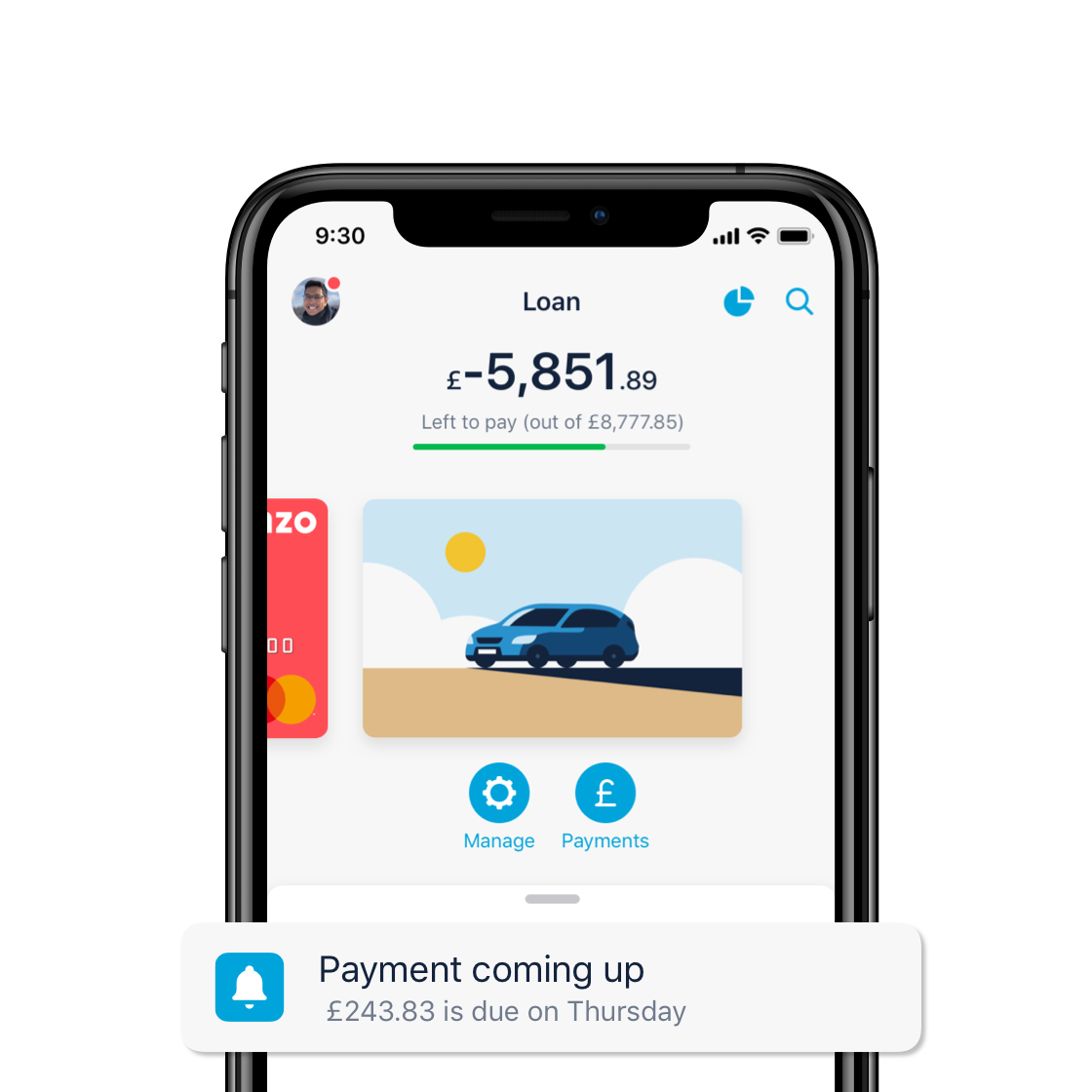

Once you've taken out your personal loan, it's easy to keep track of it.

You'll see your loan right alongside your daily spend and Savings Pots.

You're in control

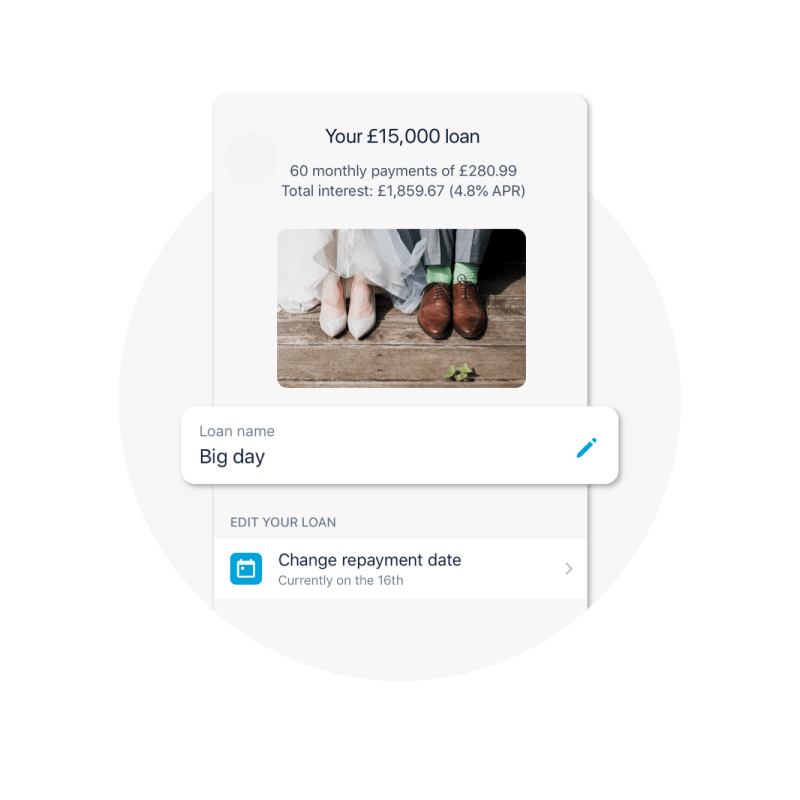

You're able to choose your payment date, and you can pay your loan back early if you'd like.

So if you end up with a little extra cash, you can pay us back sooner.

Explore in the Monzo app

By heading to your profile.

Use the loan calculator

Choose your amount, and how long you'd like your loan for. We'll show you exactly what you'll owe, with no hidden fees.

That's it!

The money's in your account almost immediately.

Give your loan a purpose

Give it a name and add an image of your choice.

Your loan sits alongside your pots, so it’s easy to see the progress you're making at a glance.

Human help, when you need it most

We want you to feel comfortable telling us when something’s wrong (whether that’s struggling with your mental health, losing your job, or something else).

If you need some extra support, we’ll do everything we can to help you get back on track.

The best way to get in touch with us is via in-app chat to discuss your circumstances with a financial difficulties specialist and find out how we can support you. You can also see how we can support with money worries if you experiencing difficulties.

We also provide tips on managing your loans and your debt in the loans help section on our blog.