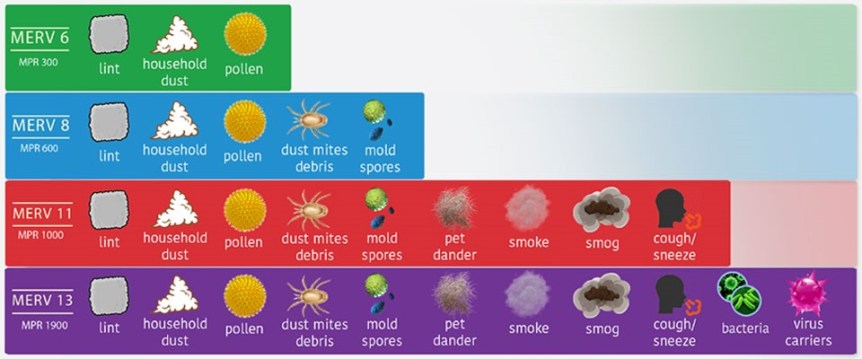

What do allergies have to do with the HVAC system? Allergies are a very common thing with many people of all ages but most are attributed to food and nature. What about the environment in our home? Multiple allergens can be found inside a home. These include mould, dust mites, pet dandruff, cockroaches, mice, etc. All these can play a …