We believe everyone should have access to emergency cash, just in case the unexpected happens. We want to help you plan, build, and maintain your savings, specifically for those times. So from today we’re introducing a new feature - safety nets - built to do just that.

What's a safety net?

A safety net is a sum of money set aside to cover essential bills and costs, just in case you ever need it. We’ll help you plan how much you’ll need to save to cover 1 month's essential expenses.

How it works

We use data from Trends to analyse your spending over the last 90 days

This helps you get a better understanding of what your essential spending looks like. You can adjust these estimates if need to so you’re always in control. You can also see how long it’ll take to reach your goal, and schedule recurring deposits.

You can earn interest on your safety net savings

We’ll set up your safety net as an Instant Access Savings Pot earning you interest as a default. But if you don't want to earn interest, we’ll set it up as a regular Pot instead.

And don’t worry if you already have an Instant Access Savings Pot, you can still choose to earn interest on your safety net. It means if you’re a Personal current account customer, you’ll have two Instant Access Savings Pots – one standalone and one that’s your safety net.

We’ll encourage you not to dip into your safety net, unless you have to

If you try to withdraw money from your safety net, we’ll remind you why it’s there and what it’s designed to be used for. This little bit of friction aims to stop you from dipping into your safety net prematurely, but you’re still in full control if you need to use this money.

How to get started

Here’s how to start building a safety net (you'll need to be on the latest version of the app first):

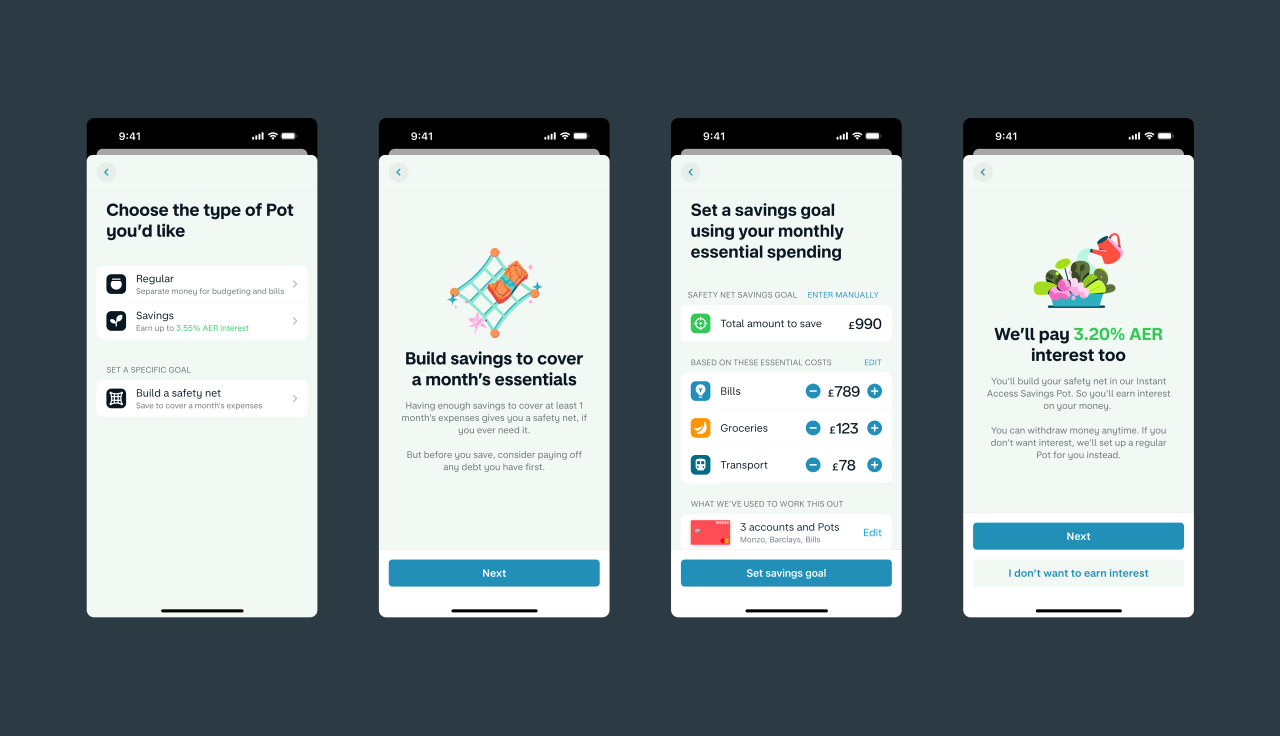

Head to the Account tab or Overview in the top left-hand corner of your Monzo app and tap Create Pot

Select Savings and choose Build a safety net

We’ll explain how we calculate your essential expenses and ask you to set a savings goal based on these estimates

You can adjust your essential spending categories and pick the accounts and Pots you’d like us to use to work out your essential spend. If you’re a Plus or Premium customer, you’ll be able to pick from your other bank accounts too.

If you choose to set up your safety net with an Instant Access Savings Pot, we’ll explain how everything works, and ask you to agree to some terms and conditions (which we’ve written in plain English and takes less than five minutes to read).

And that’s it! You’re ready to start building your safety net. You can choose how much you want to deposit right away or come back to this later.

For more help on how to get started and FAQs, visit our Help Centre.

Ts&Cs apply

Open safety netWe’d love to hear what you think! Join the discussion on Twitter or Facebook, and share your feedback on the community forum.

Don't use Monzo yet? Give it a try today!

UK residents only, Ts&Cs apply

Download MonzoWhat’s next?

We know our customers want support and guidance to build up emergency savings and improve their financial resilience. So keep your eyes peeled for some of these improvements coming soon:

Helping you save up multiple months worth of essential expenses. We’ve only built the experience to help you save for your first month so far

Celebrating when you reach your safety net goal and prompting you to keep saving for additional months if you’re able to

The ability to adjust your goal as and when your spending changes like if you move to a new flat with higher rent