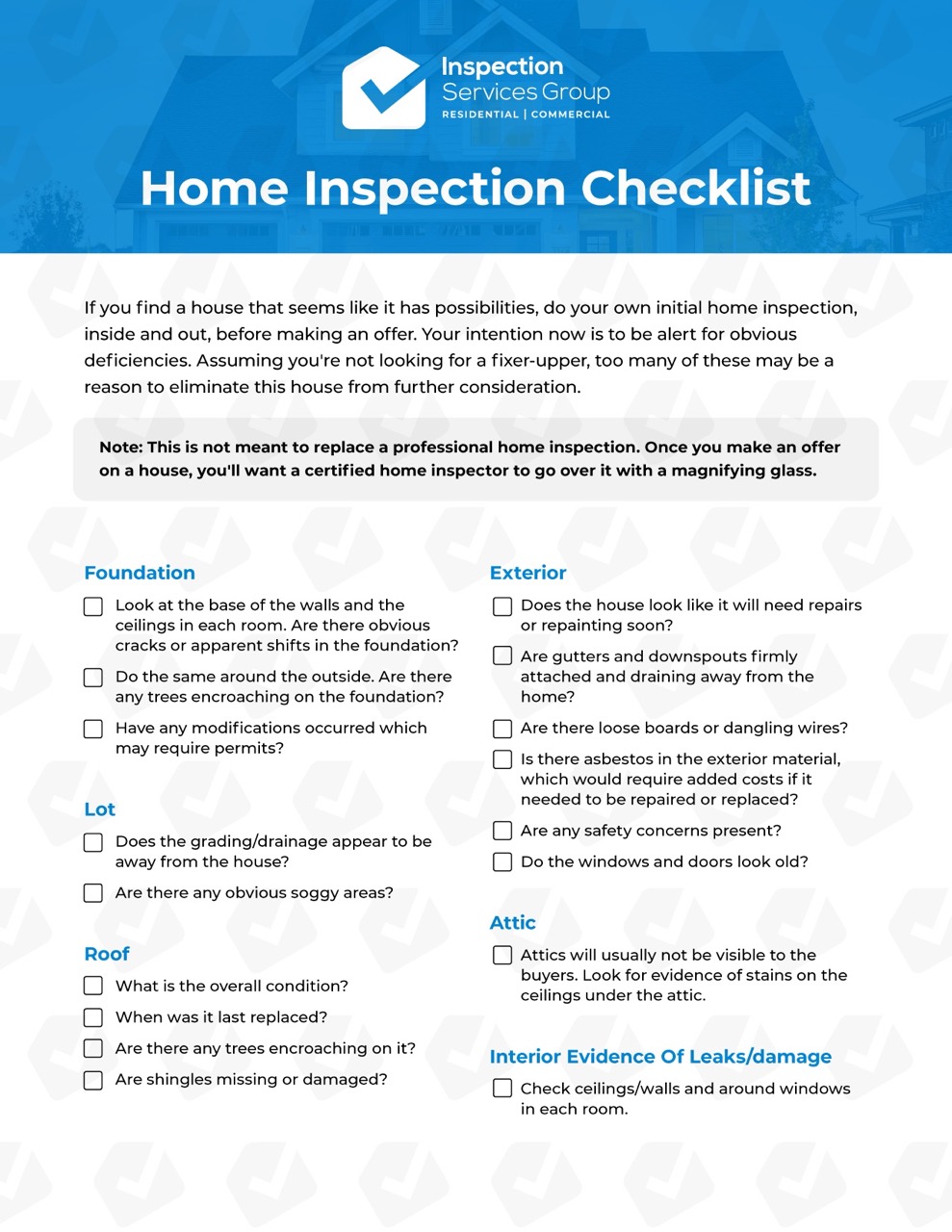

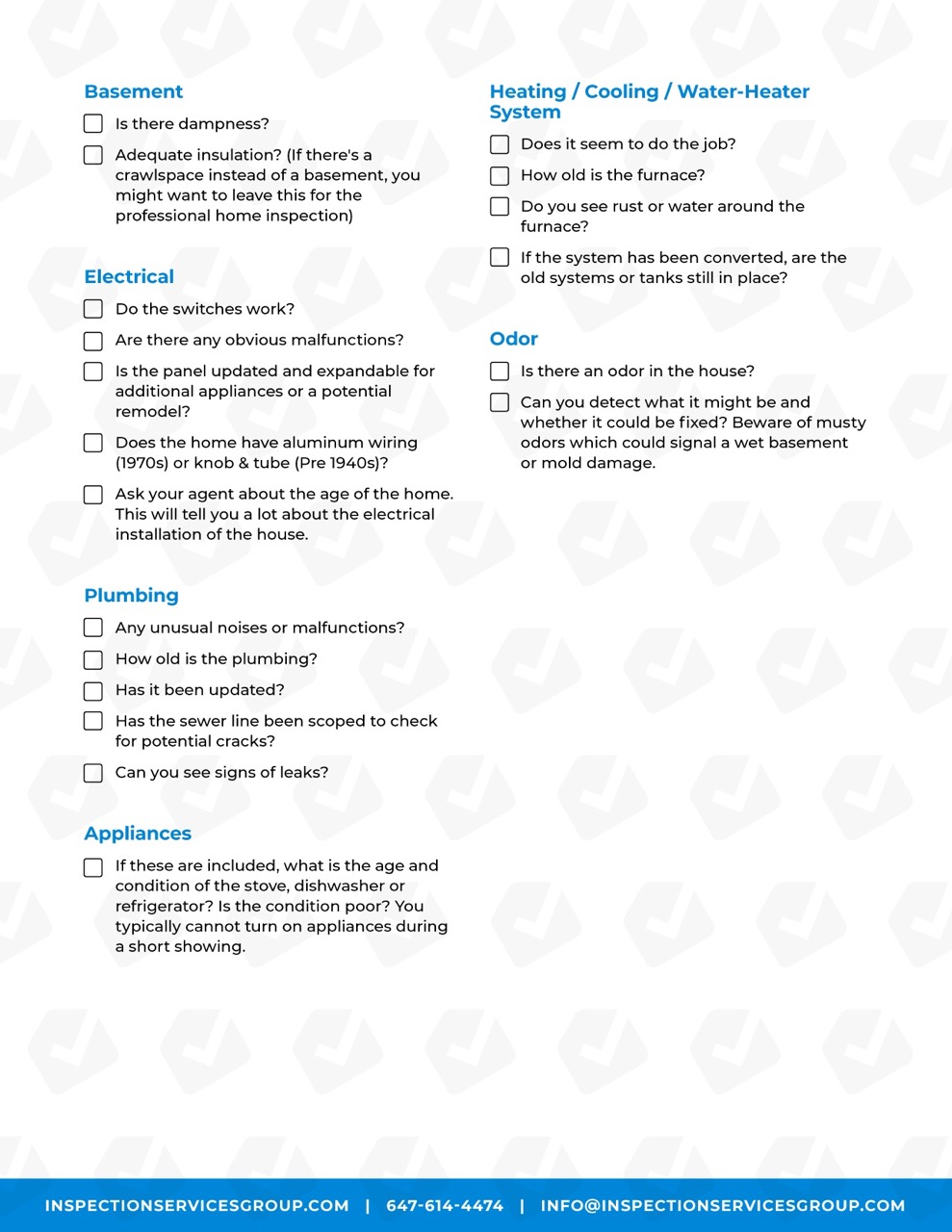

Home Inspection Checklist

Once you find a house you’re interested in, make sure to do your own initial home inspection, before making an offer. You can do this using the DIY Home Inspection Checklist that we’ve prepared below!

Before buying, you want to make sure you rule out the most obvious deficiencies (Assuming you're not looking for a fixer-upper). Too many of these deficiencies may be good reasons to remove this house from further consideration.