Well, crawlspaces like any other home component are there for a reason. The typical reason is that a basement was not required, a basement was not allowed due to high water tables or just because it saved someone money. It is rare to see crawlspaces in new construction now just because a finished basement adds living space and value to a property.

Conditioned vs Ventilated

Most people think of a crawlspace as a dark, wet and scary place like in the movies. This is often the case when crawlspaces are constructed incorrectly. When designing a crawlspace there are often two basic trains of thought. You can ventilate or condition the space. Conditioning refers to controlling the temperature and thus controlling the moisture. Careful considerations must also be taken about the climate where you are living as vented crawlspaces in arid climates tend to fare well all year long. This can also be true for regions where summers are hot and dry even if winters are cold and damp.

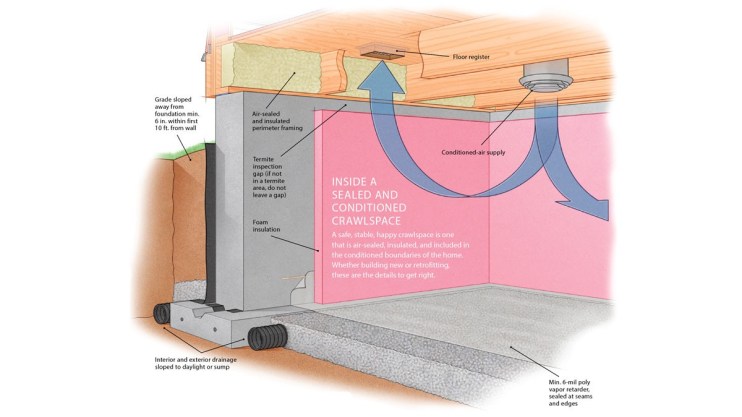

When a crawlspace is considered a conditioned portion of the home it is treated as part of the home by using the HVAC system to acclimatize and ventilation is not required. Insulating the foundation walls will provide an enhanced level of efficiency, especially in colder climates. Insulating the foundation wall was not required in the past, therefore we see a lot of older crawlspaces that do not have any insulation. Now it is required, just like a basement.

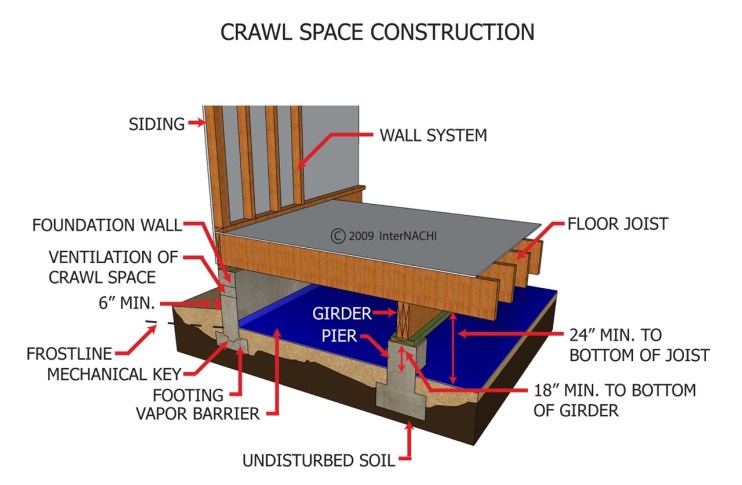

When a crawlspace is not conditioned, a few key construction techniques must be followed. It must be properly ventilated to allow moisture to dry. A vapour barrier must also be installed to prevent the evaporation of moisture from the soil. In this scenario, the best practice for insulation is to insulate the floor joist cavities but at the same time ensure that the crawlspace is vented in order to alleviate any potential for moisture problems. Think of it this way, the crawlspace should be made part of the house or treated like an exterior portion of the house.

Signs Of Problems

- Visible moisture on foundation walls or standing water is a recipe for disaster in a crawlspace and will only contribute to more problems. Water in the crawlspace indicates moisture intrusion from the exterior.

- Efflorescence can be seen on painted and non-painted walls in the crawl space. Salt deposits left behind after a wet wall dries are known as efflorescence. If you see efflorescence, it is a sign of past or current foundation water intrusion.

- If you can see condensation, you can be sure the humidity level is high. Condensation can form on metal ducts, HVAC refrigerant lines, plumbing, and even the wood itself. Subfloor insulation can also trap water and show signs of condensation. All of these issues can lead to major mould problems.

- Mould and wood rot and fungus are huge warning signs that a major water problem is present. By the time you see mould, wood rot and fungus, you may have to replace wood joists. Mould can be caused by high humidity, dew point issues, or leaks from the living space or plumbing in the crawl space.

- Pests are another sign of problems. Most insects seek out areas of high moisture areas. In some regions, there may be wood-destroying organisms, rodents or snakes.

Structural Considerations

Like any other foundation, a crawlspace must provide adequate support for the home. This means the same considerations must be taken regardless of accessibility. In many cases, this is not the case and the home is resting on concrete blocks or poorly supported with DIY materials over time. If the home is not properly supported on a block or poured foundation then it should be supported on masonry piers or steel posts with a proper concrete footing.

Radon Gas

Radon is not as big a concern in a ventilated crawlspace. Radon and other soil gases need to be addressed in conditioned crawlspaces just as they need to be addressed in basements. The best approach is the typical sub-slab depressurization (see our radon article).

FAQs

- Is there supposed to be soil on the crawlspace floor? No, but consider that building practices have changed in the last 100 years. Crawlspaces used to be left without a concrete slab or a vapour barrier up to the mid-1900s. Modern building science tells us that a crawlspace floor should have a vapour barrier to prevent the evaporation of moisture.

- Are the ducts supposed to be insulated in the crawlspace? No, they do not if your crawlspace is a conditioned area that is fully insulated at the perimeter.

- Do the water pipes need to be insulated in the crawlspace? No, they do not if your crawlspace is a conditioned area that is fully insulated at the perimeter.

- Should I be doing pest and insect control in my crawlspace? Absolutely. Every home needs pest control.

- Is a sump pump required in a crawlspace? Not necessarily. It depends on how the exterior drainage system is designed.

- What type of insulation should be used in a crawlspace? All types of insulation are good, as long as they have a high R-Value and are installed properly.

- Is mould a problem in the crawlspace if it is unconditioned and ventilated? Mould is a problem anywhere in a home.

Comments 1

Love it! But Crawl spaces are only harmful when they are improperly designed and managed. With appropriate construction and upkeep, sealed crawl spaces outperform vented crawl spaces. https://www.richmondcrawlspaceencapsulation.com